2023 Real Estate Tax Solution for Investors & Advisors

Feb 13, 2023

A Pinpoint Plan For Opportunity Zone Investors

The 2023 tax season is fully underway, and RIA’s, CPA’s, tax planners and investors alike are contemplating the best and most tax-efficient solutions for their clients, and even for themselves. Given that real estate prices on a national average are trending lower, I think there is some genuine intrigue as to whether rolling capital gains into a 1031 exchange is the wisest decision.

Two weeks ago the S&P Dow Jones Indices reported that the S&P CoreLogic Case-Shiller 20-City Composite posted a seasonally adjusted month-on-month decrease of 0.5% in November. This marks the fifth consecutive monthly decline in U.S. home prices. The 20-City Composite year-on-year appreciation posted a 6.8% gain, down from 8.6% in October. The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, a broader measure of home prices covering all nine U.S. census divisions, posted a seasonally adjusted 0.3% month-on-month decrease in November, and year-on-year appreciation of 7.7%, down from 9.2% in October.

Doug Duncan, senior vice president and chief economist at Fannie Mae, told MarketWatch in an interview two weeks ago that he expects home prices to continue to fall for several months, but that notwithstanding declining prices he still expects housing demand to help keep the economy from a severe downturn. I think in the current environment, even if Duncan is half right, executing on a 1031 exchange might be a little bit like trying to catch a falling knife. The median price of a single-family home has more than doubled in 69 metropolitan areas between 2011 and 2021—with some markets seeing 350% to 430% price increases—thanks, in part, to historically low mortgage rates and massive quantitative easing.

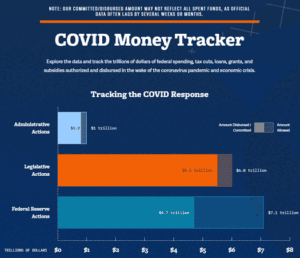

Eight rate hikes later, with maybe one or two yet to occur, I think the Fed is determined to take even more air out of the residential housing and labor markets until the annual inflation rate returns to 2%. The Fed, the Treasury, the Trump and Biden Administrations and Congress all backed phenomenal amounts of financial support, amounting to roughly $14.2 trillion being made available during the pandemic period.

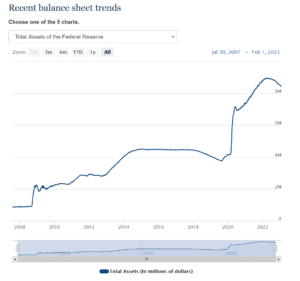

The resultant inflation in the M2 money supply, which was up by more than 40% during the pandemic, is now being unwound by the Fed’s quantitative tightening (QT) program. The Fed has been reducing its balance sheet by $95 billion per month since September, which saw M2 turn negative by 1.3% year-on-year in December, marking the first time a decline has ever been recorded in M2 since the Fed started publishing data in 1959.

At a rate $95 billion per month, the Fed is shrinking its balance sheet by $1.14 trillion per year, and to return back to the $4.1 trillion debt balance held in February 2021 before the pandemic, the Fed will have to keep at QT for another four years, as the cost of servicing that debt has soared with the overnight rate and short-term Treasuries. Maybe the Fed will be content with reducing their debt level to $6 trillion? Who knows. But what is clear is they have a lot more work to do and have been vocal about it.

If there is more air to come out of the housing market, then those seeking a different path after selling a primary residence, investment property, business or any other capital asset where the proceeds need to be re-invested, should consider Class-A multifamily real estate in markets exhibiting population growth, employment growth rates and rental growth rates.

The prospect of the Fed taking the so-called terminal rate to 5% or higher, as signaled in late 2022, might very well induce a lot of sprucing up of properties to make them available for the 2023 spring selling season. Taking care of rental properties by oneself is a ton of work. Just ask anyone who has investment property and they will very likely concur vociferously. This can be especially true for those that own rental properties that are not locally based in relation to where they live.

Whatever the case may be—downsizing, fear of price declines, changing life priorities—there are a number of reasons why investors might seek exit opportunities, but I think the most compelling strategy is the one that allows both the optionality to take a hand off the wheel, while at the same time maintaining a hand in income-producing real estate through an ownership interest in fully-managed commercial Class-A multifamily apartments complexes that are situated in desirable Opportunity Zones, loaded with tax benefits options and growth prospects.

Many of the investors that I come into contact with are already trying to get a leg up on tax season, and if you are too I think it’s important to bear in mind that the 180-day lookback period to defer short- and long-term capital gains realized in 2022 continues to tick away. Meaning that under the Opportunity Zone regulations, profits have to have been booked sometime after August 14, 2022, in order for you to still be eligible to reinvest your realized capital gains into a Qualified Opportunity Zone Fund (“QOF”), such as Belpointe OZ (NYSE American: “OZ”), and defer or even eliminate your capital gains tax obligations. But the Opportunity Zone regulations don’t just cover those that are looking for ways to shelter 2022 sales of all classes of tangible and intangible assets from taxes.

There’s also 2023 to think about, for example those investors that I speak with that are in the throes of a 1031 exchange and have sold residential properties without having identified a replacement property that qualifies as “like kind” within the 45-day deadline required by the 1031 rules, or that are struggling to arrange for attractive financing, or that have had a transaction fall apart, or that have even mistakenly bypassed using a qualified intermediary and taken possession of the sale proceeds themselves. If this is you as well, consider that in many cases those investors have still been eligible to reinvest their realized capital gains into a QOF, such as Belpointe OZ, and that you may be too.

As I noted earlier, some sellers of real estate may simply be forgoing the 1031 exchange route altogether for a variety of reasons, and, here too, it may make sense to shelter capital gains from taxes by reinvesting them into a QOF structure—like Belpointe OZ.

Finally, have you seen our commercial? It’s been running on all the major financial networks over the past several weeks and I think it addresses the 1031 exchange value proposition more succinctly than I ever could here. Check it out below:

Coming into 2023, the strategy at Belpointe OZ is simple: continue to build out full-featured Class-A apartment projects while also looking to acquire seasoned and stabilized assets that can generate income and long-term appreciation on underlying properties.

We spell out how investing in a QOF like Belpointe OZ can work for you in our white paper. Follow this link to request the Publicly Traded Opportunity Zone Investing White Paper. Want more information? There’s a wealth of detail on our website at investors.belpointeoz.com where investors and advisors alike can learn about Belpointe OZ and some of its key features.

Have questions? For immediate assistance, you can call today and I’ll take the time to answer as many of your questions about Belpointe OZ and how reinvesting capital gains into a QOF can be utilized to offset capital gains tax obligations as I can. My direct number is (203) 883-1944.

Investing in Belpointe OZ (NYSE American: “OZ”) is as simple as buying any other publicly traded equity. If you purchase Belpointe OZ’s Class A units in the open market, there is no subscription agreement or investor certification required; you can simply purchase Class A units through any brokerage account. Belpointe OZ offers the same Opportunity Zone benefits as any private structure. To properly defer your reinvested capital gains, your accountant will need to file IRS Forms 8949 and 8997 with your tax returns. You will need Belpointe OZ’s EIN which can be found here: Belpointe OZ EIN

To perhaps help facilitate the decision-making process, I want to note some features that are common to all QOFs, and some that are specific to Belpointe OZ, which I have included in bold type:

QOFs provide for pass-through income, thereby avoiding double taxation for investors;

QOFs provide for pass-through depreciation, with no depreciation recapture if an investment is held for 10 years, up to December 31, 2047;

QOFs require annual distributions of at least 90% of taxable income;

QOFs provide for up to a 20% reduction on taxable distributions via Internal Revenue Code Section 199A;

Belpointe OZ provides for asset diversification;

Belpointe OZ provides investors with greater control over their exit timing and amount;

Belpointe OZ offers low minimums for investor access;

Belpointe OZ unitholders will not be asked to add additional capital for any type of improvements or problems with investment properties;

Belpointe OZ provides investors with better reporting, transparency, and oversight;

Belpointe OZ provides investors with the opportunity for daily liquidity;

Belpointe OZ allows both accredited and non-accredited investors to access the investment class; and

Belpointe OZ simplifies the investment purchase process.

Further, in its effort to disrupt the U.S. real estate industry, Belpointe OZ is charging among the lowest fees in the market:

No investors servicing fees;

No disposition fees;

0.75% annual management fee; and

5% carried interest.

Have questions about how Belpointe OZ (NYSE American: “OZ”) can provide opportunities for investment appreciation and income and help you or your clients to defer or eliminate capital gains tax obligations?

Call me, Cody Laidlaw, at (203) 883-1944. I can answer your questions and direct you to resources that will provide you with information about the nuts and bolts of QOFs and opportunity zone investing, so you can start planning today.

You can also follow this link here to request our updated White Paper.

Cody H. Laidlaw

Editor-in-Chief

Belpointe OZ

255 Glenville Road

Greenwich, CT 06831

T: (203) 883-1944

E: IR@belpointeoz.com Disclosure: Cody H. Laidlaw is the Chief Investor Relations Officer. Cody is also an investment advisor representative with Seaside Advisory Services, Inc. (d/b/a Seaside Financial & Insurance Services), a SEC registered investment adviser offering advisory accounts and services, and holds a long position in Belpointe PREP, LLC’s Class A units. Important Information and Qualifications

Belpointe PREP, LLC (“Belpointe PREP”) has filed a registration statement (including a prospectus) with the U.S. Securities and Exchange Commission (SEC) for the offer and sale of up to $750,000,000 of Class A units representing limited liability interests in Belpointe PREP. You should read Belpointe PREP’s most recent prospectus and the other documents that it has filed with the SEC for more complete information about Belpointe PREP and the offering

Investing in Belpointe PREP’s Class A units involves a high degree of risk, including a complete loss of investment. Prior to making an investment decision, you should carefully consider Belpointe PREP’s investment objectives and strategy, risk factors, fees and expenses and any tax consequences that may results from an investment in Belpointe PREP’s Class A units. To view Belpointe PREP’s most recent prospectus containing this and other important information visit sec.gov or belpointeoz.com. Alternatively, you may request Belpointe PREP send you the prospectus by calling (203) 883-1944 or emailing claidlaw@belpointe.com. Read the prospectus in its entirety before making an investment decision.

This communication, including any links embedded herein, may not be distributed in any jurisdiction where it is unlawful to do so. Nothing in this communication is or should be construed as an offer to sell or solicitation of an offer to buy Belpointe PREP’s Class A units in any jurisdiction where it is unlawful to do so.

Neither Belpointe PREP nor any of its affiliates provide investment or tax advice and do not represent in any manner that the outcomes described herein will result in any particular tax consequence. Prospective investors should consult their own investment and tax advisers concerning the U.S. federal, state and local income tax consequences, as well as any tax consequences under the laws of any other taxing jurisdiction, in relation to their personal tax circumstances, which may vary for prospective investors in different tax situations.

This communication may contain estimates, projections and other forward-looking statements, typically identified by words and phrases such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “seek,” “should,” “will,” “would,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target” or the negative of such words and other comparable terminology. However, the absence of these words does not mean that a statement is not forward-looking. Any forward-looking statements expressing an expectation or belief as to future events is expressed in good faith and believed to be reasonable at the time such forward-looking statement is made. However, these statements are not guarantees of future events and involve risks, uncertainties and other factors beyond Belpointe PREP’s control. Therefore, we caution you against relying on any of these forward-looking statements. Actual outcomes and results may differ materially from what is expressed in any forward-looking statement. Except as required by applicable law, including federal securities laws, Belpointe PREP does not intend to update any of the forward-looking statements to conform them to actual results or revised expectations.

©2023 Belpointe PREP, LLC. All rights reserved.