Belpointe OZ Secures $104 Million Financing For St. Petersburg Florida Project

Aug 28, 2024

Second Opportunity Zone Luxury High Rise Project Approximately 50% Complete

Many of Florida’s real estate markets continue to benefit from an influx of new residents thanks in part to attractive job markets, what many consider to be an optimal climate, and friendly tax structures for both businesses and individuals. Florida’s economy is likely to remain strong, according to the 2024-2027 Florida & Metro Forecast (the “Florida Forecast”), a quarterly publication by the Institute for Economic Forecasting, an economic research institute of the College of Business Administration at the University of Central Florida led by Dr. Sean Snaith, Ph.D., a nationally recognized economist in the field of business and economic forecasting.

There are several important informational nuggets in the Florida Forecast that we believe bode well for Belpointe PREP, LLC (“Belpointe OZ”) (NYSE American: “OZ”) and its two high-rise luxury residential communities in Sarasota, Florida and St. Petersburg, Florida, and we’d like to share some of those with you here.

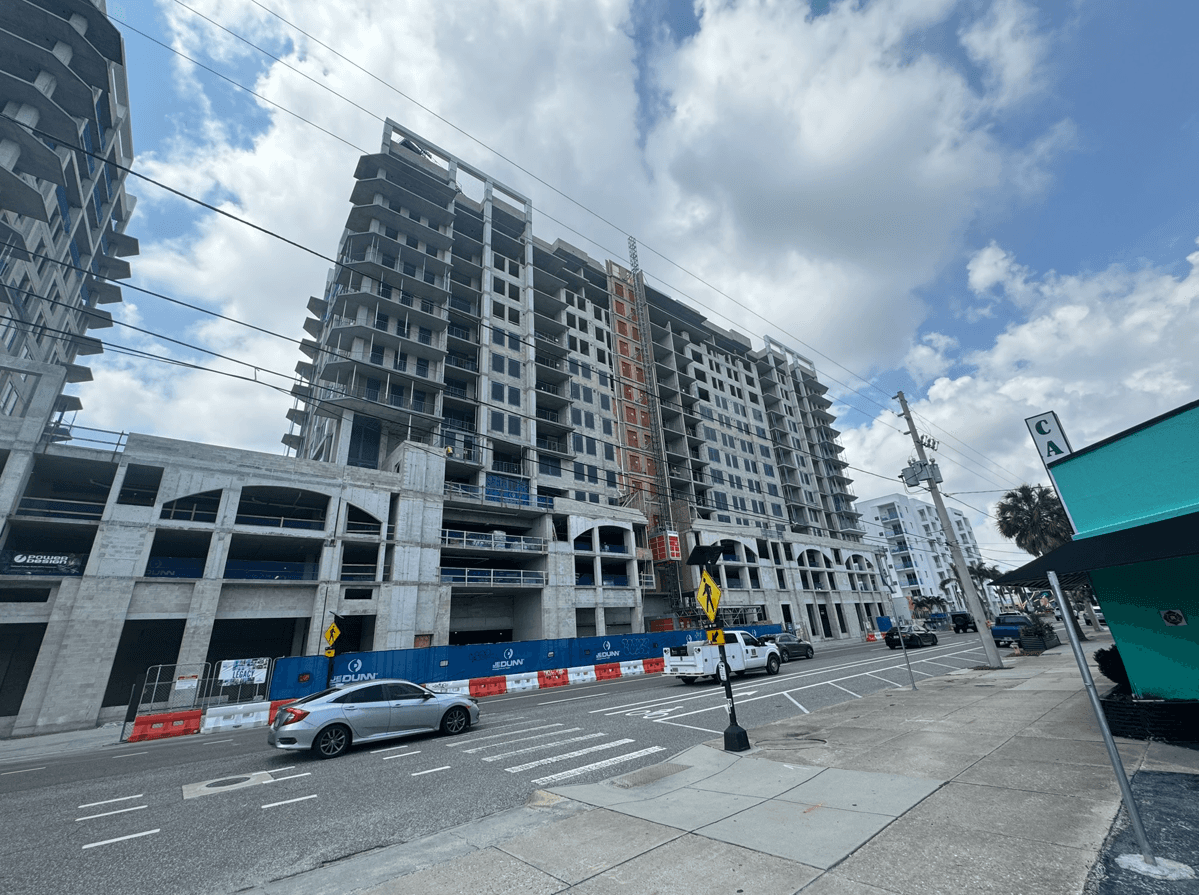

Picture of Viv

Picture of Viv

But first, for those who may have missed it previously, new residents started moving into Belpointe OZ’s Aster & Links, a multi-family community development with ground floor retail located on Main Street and Links Avenue in Sarasota, Florida.

Aster & Links spans over 650,000 square feet, and is located in downtown Sarasota, which has attractive supply/demand fundamentals and has shown strong population growth in recent years.

Now, on to some of the highlights from the Florida Forecast:

• From 2024-2027, Florida’s economy, as measured by Real Gross State Product, will expand at an average annual rate of 2.4%. …

…

• The sectors expected to have the strongest average job growth during 2024-2027 are Education & Health Services (2.1%), Leisure & Hospitality (2.0%), Construction (2.1%), Federal Government (1.9%), and State & Local Government (1.4%).

…

• Real personal income growth will average 3.6% during 2024-2027. Following an inflation-driven contraction in 2022, growth will be 3.4% in 2027. Florida’s average growth will be 1.0 percentage points higher than the national rate over the 2024-2027 four-year span.

Also noteworthy, in our view, from the Florida Forecast is that:

The median sales price for single-family homes increased by over $19,900 from April 2023, year-over-year, and now stands at $429,900—a year-over-year price appreciation of 4.9%. Price appreciation in the townhome/condominium market continues as well, with an increase in the median sales price of $10,000 year-over-year, registering at $335,000 in April of this year. This price increase represents a 3.1% increase in median prices year-over-year.

In addition to baby boomer retirees, those seeking new employment opportunities are also migrating to the Sunshine State, a trend that we believe bodes well for the general economy and for the Class-A apartment markets in hotbed growth cities.

Building on its momentum in Sarasota, Belpointe OZ also recently announced that it has secured a senior construction loan of $104 million for its 269-unit luxury multifamily building named “Viv” located in the heart of St. Petersburg, Florida.

Viv is approximately 50% finished and the loan will help facilitate the completion of the 15-story multifamily property with approximately 15,600 square feet of ground-floor retail space, 295 residential parking spaces, and 60 additional spaces for retail.

Located at 1000 1st Avenue North, Viv sits in the EDGE District neighborhood, one of the few Opportunity Zones in downtown St. Petersburg, within walking distance from Central Avenue, Tropicana Field, the waterfront, and numerous restaurants, art galleries, and entertainment venues.

Viv will feature an array of amenities, including a resort-style pool, 24-hour fitness center, sky lounge, and community pocket park. Belpointe OZ broke ground on the 1.6-acre site in May 2023. The East Tower and West Towers topped out in 2024, and the project is currently anticipated to be complete in 2025.

"This is a compelling deal for us based on the strength of the St. Petersburg market,” said Brandon Lacoff, CEO of Belpointe OZ. “We are excited to complete this transformative multifamily community that promises to fill the need for highly amenitized, quality housing in a vibrant and growing location.”

Considering the formidable progress being made by Belpointe OZ, it is our view that the market for Belpointe OZ’s Class A units fails to adequately price in the fact that Belpointe OZ owns Aster & Link, a major asset that could be stabilized and potentially generating cashflow within the next 18 months, and with financing for Viv now secured, owns a second asset set to come online and stabilize thereafter.

What’s more, investors do not need capital gains to take advantage of the current NAV-to-Class A unit price disparity. We believe that investors seeking hard real estate assets with income-producing potential, trading at a steep discount to NAV and located within one of the fastest growing states in the U.S., should give thought to adding Belpointe OZ’s Class A units to a diversified portfolio of investments.

As of July 22, 2024, Belpointe OZ, the only publicly traded qualified opportunity fund, announced its unaudited quarterly net asset value (“NAV”) as of March 31, 2024 of $361.66 million, or $99.59 per Class A unit. In our view, investors seeking a discounted real estate investment opportunity should consider exploiting the disparity between the current market price of Belpointe OZ’s (NYSE American: “OZ”) Class A units and its NAV, notwithstanding the tax benefits that Belpointe OZ, as a Qualified Opportunity Fund, has to offer.

Investors and future tenants can now preview and lease the available units and floorplans on the updated Aster & Links website, which displays the luxurious layouts with living spaces from 865 to 2,820 sq. feet, one-bed/one-bath to four-bed/three-and-a-half-bath and a wide array of options to fit the needs and wants of all future tenants.

Tech investors in particular are enjoying generational wealth-building capital gains in the leading AI stocks. It might be time to consider sheltering some of those gains and potentially compounding them in a tax-deferred Opportunity Zone Fund that trades on the NYSE.

Belpointe OZ

255 Glenville Road

Greenwich, CT 06831

T: (203) 883-1944

The information in this communication is for illustrative, educational and informational purposes only and is subject to change. Nothing in this communication is or should be construed as an offer to sell or the solicitation of an offer to buy any securities. Offers may only be made by means of a prospectus.

Belpointe PREP, LLC (“Belpointe OZ”) has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Prior to making an investment decision, you should read Belpointe OZ’s prospectus and the other documents that it has filed with the SEC in their entirety, and carefully consider its investment objectives and strategy, risk factors, fees and expenses and any tax consequences that may results from an investment in the offering. Copies of these documents can be obtained free of charge from www.sec.gov or investors.belpointeoz.com or from any broker-dealer participating in the offering.

The information in this communication should not be relied upon as investment or tax advice. You should consult with your own investment and tax advisers concerning the federal, state and local income tax consequences of purchasing, owning or disposing of securities in the offering, and of Belpointe OZ’s election to qualify as a partnership and qualified opportunity fund for federal income tax purposes. There is no guarantee that Belpointe OZ will continue to qualify as a partnership or qualified opportunity fund.

Past performance is not an indicator or a guarantee of future performance. An investment in the offering to which this communication relates involves a high degree of risk, including a complete loss of your investment, and may not be suitable for all investors. The price of Belpointe OZ’s securities will fluctuate in market value and may trade above or below net asset value. Brokerage commissions and expenses will reduce returns.

The offering to which this communication relates is being made on a best-efforts basis on behalf of Belpointe OZ through Emerson Equity, LLC, Member FINRA, SIPC, as managing broker-dealer.

©2024 Belpointe PREP, LLC. All rights reserved.