Special 2022/23 Opportunity Zone Tax Breaks

Mar 9, 2023

Rental Market Stays Solid Amidst Declining Home Starts

Bond yields are back on the rise and many fear that the Federal Reserve’s aggressive interest rates policy will continue until at least Federal Open Market Committee’s (“FOMC”) meeting in July 2023. While the year started strongly for the stock market, the most recent change in sentiment has clipped a good portion of the year-to-date stock market gains. All the first-of-the-year pension funding generally helps to bring fresh fund flows into equities, and some investors may have been counting on the rapid deceleration of inflation that certain pundits were embracing in early January 2023.

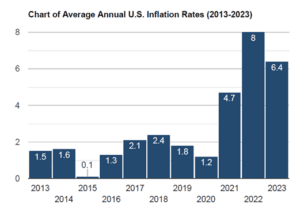

A string of hopeful economic data related to January 2023 retail sales, employment, CPI, PPI and PCE kept inflation elevated prompting predictions that the Federal Reserve will act more aggressively. The present annual rate of inflation is running around 6.4%, according to the Labor Department data published on February 14, 2023. The next set of inflation data points will cross the tape in mid-March, right before the next scheduled FOMC meeting on March 21-22, 2023.

Source: U.S. Inflation Calculator (Accessed March 6, 2023)

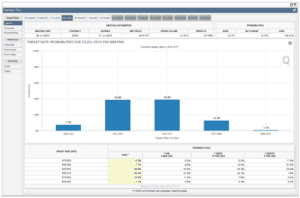

Granted, the trend of inflation is ebbing, but it seems not nearly at a pace the Federal Reserve is comfortable with, raising concerns that the Federal Reserve will take the current Fed Funds rate from 4.50%-4.75% to 5.50%-5.75% by the July 26th meeting (as of March 6, 2023 the CME FedWatch Tool indicate a 39.4% probability), or maybe even higher if the upcoming inflation surprises to the upside as the PCE index did. A week ago, the probability was 32.7% of a 100-basis point move higher, and back in early February, there was 1.6% percent chance of it. This shift in sentiment most likely accounts for the stock market pullback.

Source: CME FedWatch Tool (Accessed March 6, 2023)

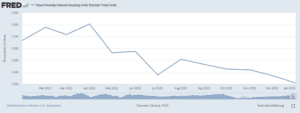

All this data, in my opinion, supports a conclusion that residential builders are not willing to commit their capital toward new projects when the cost of construction loans are bumping higher along with higher hourly wages. Here is where it gets interesting for market participants. As far as inflation effects on the housing market, new home construction fell again in January, the fifth straight month of declines, adding to the longstanding inventory problem.

Tight inventory has kept prices from substantially dropping off, making homes still unaffordable for many, especially first-time homebuyers. Those homebuyers that are locked into super-low rates for purchases and refinancing's are staying put. As a result, the residential home market is not likely to adjust much lower for those seeking to buy homes, even as 30-year mortgage rates approach 7%.

Source: Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis (Accessed March 6, 2023)

At the same, I think, this particular set of market conditions puts a seemingly strong bid under Class-A, full-featured apartment communities as a safer avenue for figuring out the broad economic landscape going forward. In my view, this makes perfectly good sense to keep one’s options completely open against inflation and rising rates. As I’ve noted in previous blogs, maintaining optionality in the present economy for many people is prudent when the road ahead is not so smooth. Hence, the potential allure of the high-end rental.

The 5-month decline in private residence new home construction also portends a housing shortage for longer than had been anticipated. It sets up those developers of high-end apartment complexes for a strong run for the foreseeable future. Combining these benefits within the opportunity zone funds structure that offers attractive tax benefits and potential for rising dividend income and long-term capital appreciation can be a compelling investment proposition in a landscape of collective fluid situations.

Investors still have time to defer capital gains from the sale of stocks, bonds, ETFs, mutual funds, real estate, businesses, collectibles, non-tangible assets, etc., going back to the first week of September 2022. For some, this is a terrific tax planning tool.

Speaking of tax planning, Belpointe OZ (NYSE American: “OZ”) is currently expecting 2022 Schedule K-1s to be sent out in early April. If you have any questions, please do not hesitate to contact us.

This is where the investment proposition regarding Belpointe OZ (NYSE American: “OZ”) comes into focus. Belpointe OZ is continuously seeking to acquire stabilized assets in those cities where we believe population growth and diversified job growth are experiencing uptrends. Out of the many Opportunity Zones that we’ve reviewed (and there are more than 8,700 of them designated by the government), we believe that there are less than 100 that are worth investing in. Our development team is comprised of executives with combined decades of experience in bringing projects online in the Class-A multi-family apartment sector. We believe in our acquisition strategy for the following reasons:

Stabilized Asset Acquisition Strategy: Belpointe OZ is the only publicly traded Opportunity Zone structure, which allows it to acquire other Qualified Opportunity Funds and their opportunity zone assets without causing an inclusion event. This, in turn, allows Belpointe OZ to preserve the Opportunity Zone tax benefits for the acquisition target’s investors and ultimately provide OZ’s unitholders with newly built qualified opportunity zone assets that are stabilized and focused on generating positive cash flow with minimal construction risk. Win #1: Sponsors of the acquired Opportunity Zone Funds. Typically, a development project takes approximately 2 years to complete. Afterwards Qualified Opportunity Funds and their sponsors are required to hold completed assets for an additional 8 years to meet the minimum 10-year holding period required to receive the full Opportunity Zone tax benefits. Conversely, Belpointe OZ’s unique ability to acquire other Qualified Opportunity Funds without triggering an inclusion event for the acquisition target’s investors provides sponsors with the flexibility to exit their investment vehicles up to 8 years earlier than previously planned. This provides sponsors the option to receive their carried interest profits up to 8 years faster than expected. Win #2: Investors of the acquired Opportunity Zone Funds. Investors benefit from the ability of Belpointe OZ to acquire their Qualified Opportunity Funds because they may be able to recognize gains from their investments without losing any of their Opportunity Zones tax benefits. Additionally, there is a number of other benefits that Belpointe OZ provides for its unitholders, such as: greater diversification, liquidity, lower fees, unitholders’ investment exit control, and up to 20% tax deduction benefit on income that exceeds depreciation (via Internal Revenue Code Section 199A). Win #3: Existing OZ Unitholders. Belpointe OZ’s existing unitholders also benefit when Belpointe OZ acquires other Qualified Opportunity Funds, as such acquisitions may increase Belpointe OZ’s cash flow from operations and possibly decrease risk by improving investment diversification and eliminating construction and development risks.

In sum, I see this year as one of teeing up properties for lease up in 2024 and seeking to acquire stabilized assets and growing the portfolio to deliver potential future capital appreciation and a rising stream of dividend income.

Many of the investors that I come into contact with are already trying to get a leg up on tax season, and if you are too, I think it’s important to bear in mind that the 180-day lookback period to defer short- and long-term capital gains realized in 2022 continues to tick away. Meaning that under the Opportunity Zone regulations, the lookback period to offset capital gains with the purchase of OZ shares is around September 5, depending on when you receive this update.

Want more information? There’s a wealth of detail on our website at investors.belpointeoz.com where investors and advisors alike can learn about Belpointe OZ and some of its key features.

Have questions about how Belpointe OZ (NYSE American: “OZ”) can provide opportunities for investment appreciation and income and help you or your clients to defer or eliminate capital gains tax obligations?

Call me, Cody Laidlaw, at (203) 883-1944. I can answer your questions and direct you to resources that will provide you with information about the nuts and bolts of QOFs and opportunity zone investing, so you can start planning today.

Cody H. Laidlaw

Editor-in-Chief

Belpointe OZ

255 Glenville Road

Greenwich, CT 06831

T: (203) 883-1944

E: IR@belpointeoz.com Disclosure: Cody H. Laidlaw is the Chief Investor Relations Officer. Cody is also an investment advisor representative with Seaside Advisory Services, Inc. (d/b/a Seaside Financial & Insurance Services), a SEC registered investment adviser offering advisory accounts and services, and holds a long position in Belpointe PREP, LLC’s Class A units. Important Information and Qualifications

Belpointe PREP, LLC (“Belpointe PREP”) has filed a registration statement (including a prospectus) with the U.S. Securities and Exchange Commission (SEC) for the offer and sale of up to $750,000,000 of Class A units representing limited liability interests in Belpointe PREP. You should read Belpointe PREP’s most recent prospectus and the other documents that it has filed with the SEC for more complete information about Belpointe PREP and the offering

Investing in Belpointe PREP’s Class A units involves a high degree of risk, including a complete loss of investment. Prior to making an investment decision, you should carefully consider Belpointe PREP’s investment objectives and strategy, risk factors, fees and expenses and any tax consequences that may results from an investment in Belpointe PREP’s Class A units. To view Belpointe PREP’s most recent prospectus containing this and other important information visit sec.gov or belpointeoz.com. Alternatively, you may request Belpointe PREP send you the prospectus by calling (203) 883-1944 or emailing claidlaw@belpointe.com. Read the prospectus in its entirety before making an investment decision.

This communication, including any links embedded herein, may not be distributed in any jurisdiction where it is unlawful to do so. Nothing in this communication is or should be construed as an offer to sell or solicitation of an offer to buy Belpointe PREP’s Class A units in any jurisdiction where it is unlawful to do so.

Neither Belpointe PREP nor any of its affiliates provide investment or tax advice and do not represent in any manner that the outcomes described herein will result in any particular tax consequence. Prospective investors should consult their own investment and tax advisers concerning the U.S. federal, state and local income tax consequences, as well as any tax consequences under the laws of any other taxing jurisdiction, in relation to their personal tax circumstances, which may vary for prospective investors in different tax situations.

This communication may contain estimates, projections and other forward-looking statements, typically identified by words and phrases such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “seek,” “should,” “will,” “would,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target” or the negative of such words and other comparable terminology. However, the absence of these words does not mean that a statement is not forward-looking. Any forward-looking statements expressing an expectation or belief as to future events is expressed in good faith and believed to be reasonable at the time such forward-looking statement is made. However, these statements are not guarantees of future events and involve risks, uncertainties and other factors beyond Belpointe PREP’s control. Therefore, we caution you against relying on any of these forward-looking statements. Actual outcomes and results may differ materially from what is expressed in any forward-looking statement. Except as required by applicable law, including federal securities laws, Belpointe PREP does not intend to update any of the forward-looking statements to conform them to actual results or revised expectations.

©2023 Belpointe PREP, LLC. All rights reserved.