Sarasota and St. Petersburg Hold Great Promise For Profits

As we enter the mid-point of 2023, I wanted to impress upon investors, brokers, CFPs, RIAs and others to consider the possibility of dislocation in some sub-sectors of the real estate market. Few can deny the strength of certain single-family home markets due to ongoing supply shortages in the most desirable markets. In my experience, the data varies from whom I talk to, but the net result is the same, they all agree inventory is well shy of what is needed.

A Wall Street Journal article dated April 14, 2023 put the shortage this way:

While everyone seems to agree there’s a housing shortage, there’s little agreement on its magnitude. The National Low Income Housing Coalition says the U.S. has a shortage of 7.3 million units, Realtor.com says 6.5 million, mortgage-finance company Fannie Mae says 4.4 million and Up for Growth, a policy group focused on the housing shortage, says 3.8 million units. John Burns Research & Consulting, a real-estate industry consultant, puts it at just 1.7 million.

Addressing the market for affordable housing in promising opportunity zones is one of Belpointe PREP, LLC’s (“Belpointe OZ”) (NYSE American: OZ) priorities. Out of the many opportunity zones that we have reviewed at Belpointe OZ (and there are more than 8,700 of them), we believe that there are less than 100 worth investing in. In addition to Sarasota, Belpointe OZ owns three properties just up the road in St. Petersburg, the coastal part of the greater Tampa, Florida area. Roughly 70% of our capital commitments and current portfolio holdings are invested in Sarasota and St. Petersburg.

Based on data from Zillow through April 30, 2023, the Sarasota housing market is forecasted to continue its upward trend in 2023, with an average home value of $461,770, up 5.0% over the past year, and, according to Norada Real Estate Investments, a turnkey real estate investment firm, “with strong demand, low inventory, and a high median sale-to-list ratio, now is a great time to invest in Sarasota real estate.” In addition, an April 2023 study from Redfin shows several Florida metros are among the fastest growing areas for median house prices across the country.

Source: OpportunityDB, List of Sarasota, Florida Opportunity Zones & OZ Funds (last accessed June 4, 2023).

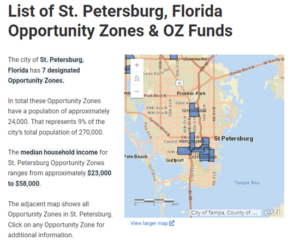

Source: OpportunityDB, List of St. Petersburg, Florida Opportunity Zones & OZ Funds (last accessed June 4, 2023).

Click on the link below to take you to the website to review Belpointe OZ’s properties in the various phases of conception of project, remodel, ground up construction and acquisition.

https://investors.belpointeoz.com/select-oz-development-sites/

Current events driving Belpointe OZ in 2023 include the May 17th announcement of the commencement of an offering to raise up to $750 million in capital. This latest offering also affords broker-dealers the opportunity to participate in the selling group, and Belpointe OZ has retained Emerson Equity LLC as dealer manager for the offering. Interested broker-dealers may contact Cody Laidlaw at IR@BelpointeOZ.com or call 203-883-1944 for further information.

Additionally, on May 24th, Belpointe OZ announced the signing of a definitive lease agreement with Sprouts Farmers Market, one of the largest and fastest-growing specialty retailers of fresh, natural and organic food in the United States. Sprouts will occupy approximately 23,000 sq. ft. at Belpointe OZ’s 1991 Main Street development in Sarasota, Florida—a two building development dubbed “Aster & Links”—marking a major milestone for the development.

Aster & Links is currently expected to consist of 424 apartment homes that range from one-bedroom, two-bedroom, three-bedroom apartments to four-bedroom townhome-style penthouses spread throughout two high-rise buildings with 7 stories in the front and 10 stories in the rear, and over 900 parking spaces consisting of garage and surface parking. Aster & Links will offer full amenities such as a clubroom, fitness room, center courtyard with heated saltwater pool, and roof top amenities including a community room and a private dining area for private events as well as outdoor grills and seating.

To finish out the month of May on a high note, Belpointe OZ announced its unaudited quarterly net asset value (“NAV”) as of March 31, 2023 of $351.7 million or $99.82 per Class A unit. In response, Brandon Lacoff, CEO of Belpointe OZ, had this to say:

Our portfolio of well-located multifamily development sites in fundamentally strong markets has fared extremely well during these challenging economic times. Despite recent pricing, supply chain and labor issues, we continue to make strong progress on our 424-unit development aptly named ‘Aster & Links’ in Sarasota, Florida, which is approximately 35% complete and scheduled to deliver its first units in the spring of 2024.

As interest rates have risen year-to-date, valuations of some publicly traded REITs have been under pressure, with the dumping of office properties being one potential culprit as the trend of return-to-office has stalled out in some sectors. I think this fallout in the office properties sub-sector of commercial real estate has weighed on the entire REIT universe.

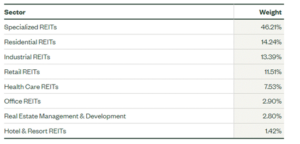

To bring this point to light, shares of the S&P 500 Real Estate SPDR (NYSE Arva: XLRE) are trading down by about -19% from an August 15, 2022 peak of $45.74, with this benchmark ETF having only a 2.90% weighting in Office REITs as of June 1, 2023.

Source: Barchart, S&P 500 Real Estate Sector SPDR (XLRE) (last accessed June 4, 2023).

XLRE’s top holdings in the Specialized REIT category include data centers, cell towers, warehouse fulfillment and self-storage. Notice the second largest category is residential REITs anchored by Avalon Bay Communities, Inc. (NYSE: AVB) with a $25.73 billion market cap, one of the largest in the space. Just as a side note, some of Belpointe OZ’s executive team consists of former Avalon Bay officers, providing Belpointe OZ with seasoned professionals with deep experience in scaling multi-family real estate business operations.

Source: The Real Estate Select Sector SPDR® Fund (last accessed June 4, 2023).

My point with this illustration is that, as noted, the NAV of a Belpointe OZ Class A unit is $99.82 and yet as of June 2, 2023 the Class A units were trading at around $88.75, an 11% discount to NAV.

Belpointe OZ is the only publicly traded qualified opportunity fund (“QOF”) that is building and acquiring full-featured Class A apartment complexes in cities that, according to our research, are continuing to grow, like Sarasota, Florida, and Nashville, Tennessee.

QOFs offer investors looking to shelter capital gains have a viable opportunity. As part of the program structure, any taxable gain invested in a QOF is not recognized (on the federal level and in many states) until December 31, 2026 (due with the filing of the 2026 return in 2027), or until the interest in the QOF is sold or exchanged, whichever occurs first. The potential to compound growth and income thereafter within QOFs expires December 31, 2047.

Moreover, I believe Belpointe OZ represents an attractive alternative to Internal Revenue Code Section 1031 like-kind exchanges. Investors that have sold real estate within the past 180 days and that may be under pressure to comply with Section 1031 regulations in order to complete a tax-free exchange, may want to avoid the inconvenience of having to identify a replacement property (and one or more alternative replacement properties, just in case a replacement property falls through) within 45 days of selling the original property, escrowing the sale proceeds with a 1031 qualified intermediary, and closing on a replacement property within 180 days of the sale of the original property. Instead, investors may want to consider investing capital gains from the sale of the original property into a QOF like Belpointe OZ.

Further, in its effort to disrupt the U.S. real estate industry, Belpointe OZ is charging among the lowest fees in the market, including:

• No investors servicing fees;

• No disposition fees;

• 0.75% annual management fee; and

• 5% carried interest.

Those investors that have filed a tax extension or may be considering an amendment and who are sitting on capital gains that were realized at the end of 2022 can still take full advantage of deferring payment of taxes on those capital gains by purchasing Class A units in Belpointe OZ (NYSE American: “OZ”), and taking advantage of the 180-day look-back window that allows capital gains realized in December 2022, to be offset and not recognized until December 31, 2026. In the meantime, the potential growth and income from those invested capital gains can be compounding free of taxation as long as the investor holds their interest in Belpointe OZ for at least 10 years, through December 31, 2047. Again, there is no limit on how much in realized capital gains one can reinvest into a QOF.

Have questions? You can contact me, Cody Laidlaw, at (203) 883-1944. I can answer as many of your questions as possible and direct you to resources that will provide you with information about the nuts and bolts of QOFs and opportunity zone investing, so you can start planning today.

Cody H. Laidlaw

Editor-in-Chief

255 Glenville Road

Greenwich, CT 06831

T: (203) 883-1944

E: IR@belpointeoz.com

Disclosure: Cody H. Laidlaw is the Chief Business Development Officer and Head of Investor Relations. Cody is also an investment advisor representative with Seaside Advisory Services, Inc. (d/b/a Seaside Financial & Insurance Services), a SEC registered investment adviser offering advisory accounts and services, and holds a long position in Belpointe PREP, LLC’s Class A units.

The information in this communication is for illustrative, educational and informational purposes only and is subject to change. Nothing in this communication is or should be construed as an offer to sell or the solicitation of an offer to buy any securities. Offers may only be made by means of a prospectus.

Belpointe PREP, LLC (“Belpointe OZ”) has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Prior to making an investment decision, you should read Belpointe OZ’s prospectus and the other documents that it has filed with the SEC in their entirety, and carefully consider its investment objectives and strategy, risk factors, fees and expenses and any tax consequences that may results from an investment in the offering. Copies of these documents can be obtained free of charge from www.sec.gov or www.investors.belpointeoz.com or from any broker-dealer participating in the offering.

The information in this communication should not be relied upon as investment or tax advice. You should consult with your own investment and tax advisers concerning the federal, state and local income tax consequences of purchasing, owning or disposing of securities in the offering, and of Belpointe OZ’s election to qualify as a partnership and qualified opportunity fund for federal income tax purposes. There is no guarantee that Belpointe OZ will continue to qualify as a partnership or qualified opportunity fund.

Past performance is not an indicator or a guarantee of future performance. An investment in the offering to which this communication relates involves a high degree of risk, including a complete loss of your investment, and may not be suitable for all investors. The price of Belpointe OZ’s securities will fluctuate in market value and may trade above or below net asset value. Brokerage commissions and expenses will reduce returns.

The offering to which this communication relates is being made on a best-efforts basis on behalf of Belpointe OZ through Emerson Equity, LLC, Member FINRA, SIPC, as managing broker-dealer.

©2023 Belpointe PREP, LLC. All rights reserved.