Investors Weigh Locking-In Long Term Embedded Gains

Inflation is surging. Gas, food and healthcare prices are soaring, and rents are being firmly adjusted higher. None of these necessities, along with essentials like power, water, broadband and wireless communications bills, are likely to be getting any cheaper in foreseeable future, and quite frankly, only look poised to rise further.

Evidence of a bear market in the making grows with each passing week, as investors seem to be weighing the prospects of radically reducing the size of stock portfolios that have served them so well for the past 12 years. The S&P 500 hit a low of 666 in March 2009 and roared higher to an all-time high of 4,818 in the first week of 2022 for a 723% gain thanks to trillions upon trillions of dollars of stimulus.

It’s been a phenomenal run that has fueled appreciation of all classes of assets—stocks, real estate, business startups and collectibles being the primary beneficiaries. The firehose of government-sponsored capital also came at a lending rate that was next to zero for creditworthy borrowers—financial engineering, manipulation, and opportunity at its finest.

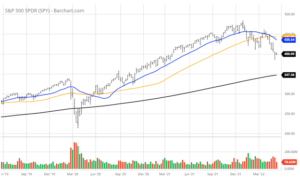

In the span of just two months, this great aircraft carrier of quantitative easing and low-interest rates seems to have all but ended. While the correction in equity markets may well be underway, there may also be considerably more downside ahead. I’m not talking about round-tripping a 723% return, but how about a possible pullback to the 156-week moving average (the black line in the below chart) to around 3,450? That would imply another 12% of downside risk to the S&P, resulting in a total possible drawdown of 28% for passive stock market investors.

So, what’s another 12% of possible selling pressure? How painful can that really be? Well, based on the drama being played out on CNBC, Bloomberg and Fox Business, it sounds like the world is coming to an end, because fear sells, and stocks fall faster than they rise. Fueling this potential pullback is a late-to-the-party Fed that has to close the gap on inflation, while shortages in labor and commodities, a prolonged war in Ukraine, lockdowns in China and backed up seaports are suffocating demand in end markets.

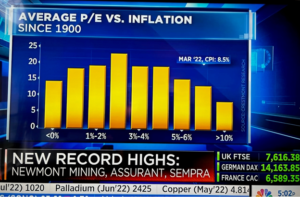

For 2022, Wall Street consensus analyst estimates are forecasting S&P 500 operating earnings of $228 per share according to J.P. Morgan Asset Management (Source: https://am.jpmorgan.com/content/dam/jpm-am-aem/global/en/insights/market-insights/guide-to-the-markets/mi-guide-to-the-markets-us.pdf). Using history as a guide, a move for the S&P down to 3,450 would represent a P/E of 14.3x, well above the average P/E of 8.1x witnessed in the most recent period where inflation was at 8% or higher (i.e., 1978-1981). I think smart money is all too cognizant of this data and may be lowering stock exposure with every rally until inflation data peaks and begins to recede.

Source: www.cnbc.com

Against this backdrop for stocks, domestic commercial real estate investing in multi-family housing developments may seem like an oasis for investors looking to own inflation-sensitive assets that have the potential to deliver income and capital appreciation. As such, I believe that investors locking in deeply embedded stock market gains earned over the past 12 years should look at residential real estate funds as their asset class of choice when reallocating those market proceeds.

In this situation, investors who booked stock market gains in the last 180 days should consider reinvesting those gains into a Qualified Opportunity Zone Fund (QOF). Belpointe PREP, LLC (NYSE American: “OZ”) is positioned in what I believe is the sweet spot of the broader real estate investment sector. Belpointe PREP is building and acquiring multi-family residential Class A luxury apartment dwellings within opportunity zones (OZs) in cities like Nashville, TN, and Sarasota/St. Petersburg, FL.

In addition, Belpointe PREP’s management team is actively seeking to acquire other QOFs that have stabilized their properties, and I believe there are some clear benefits to acquiring seasoned properties in lieu of new construction with all its attendant risks.

Belpointe PREP (NYSE American: “OZ”) is the first and thus far only publicly listed QOF and it requires no paperwork or documentation to invest. Belpointe PREP provides investors with the ability to pair off 2021 year-end gains (as well as year-to-date 2022 gains), using a 180-day look-back window, and reinvest those capital gains to defer taxes, in addition to offering investors an opportunity for growth and income for the next five years, out to December 31, 2026, where all capital appreciation and the majority of pass-through income may be tax-free.

The window to shelter 2021 capital gains narrows with each passing day—going back, as of this writing, to November 21, 2021. There is still time to allocate year-end 2021 capital gains in all asset classes: stocks, bonds, real estate, sale of a business or a partial stake, precious metals, crypto profits, livestock, and collectibles; they all qualify and realized capital gains from any of them can be offset with like-kind dollar amount purchases of Belpointe PREP (NYSE American: “OZ”) stock. All with a couple of clicks of a mouse.

Cody H. Laidlaw

Editor-in-Chief

Belpointe OZ

255 Glenville Road

Greenwich, CT 06831

T: (203) 883-1944

E: IR@belpointeoz.com

Disclosure: Cody H. Laidlaw is the Chief Investor Relations Officer. Cody is also an investment advisor representative with Seaside Advisory Services, Inc. (d/b/a Seaside Financial & Insurance Services), a SEC registered investment adviser offering advisory accounts and services, and holds a long position in Belpointe PREP, LLC’s Class A units.

Important Information and Qualifications

Belpointe PREP, LLC (“Belpointe PREP”) has filed a registration statement (including a prospectus) with the U.S. Securities and Exchange Commission (SEC) for the offer and sale of up to $750,000,000 of Class A units representing limited liability interests in Belpointe PREP. You should read Belpointe PREP’s most recent prospectus and the other documents that it has filed with the SEC for more complete information about Belpointe PREP and the offering

Investing in Belpointe PREP’s Class A units involves a high degree of risk, including a complete loss of investment. Prior to making an investment decision, you should carefully consider Belpointe PREP’s investment objectives and strategy, risk factors, fees and expenses and any tax consequences that may results from an investment in Belpointe PREP’s Class A units. To view Belpointe PREP’s most recent prospectus containing this and other important information visit sec.gov or belpointeoz.com. Alternatively, you may request Belpointe PREP send you the prospectus by calling (203) 883-1944 or emailing claidlaw@belpointe.com. Read the prospectus in its entirety before making an investment decision.

This communication, including any links embedded herein, may not be distributed in any jurisdiction where it is unlawful to do so. Nothing in this communication is or should be construed as an offer to sell or solicitation of an offer to buy Belpointe PREP’s Class A units in any jurisdiction where it is unlawful to do so.

Neither Belpointe PREP nor any of its affiliates provide investment or tax advice and do not represent in any manner that the outcomes described herein will result in any particular tax consequence. Prospective investors should consult their own investment and tax advisers concerning the U.S. federal, state and local income tax consequences, as well as any tax consequences under the laws of any other taxing jurisdiction, in relation to their personal tax circumstances, which may vary for prospective investors in different tax situations.

This communication may contain estimates, projections and other forward-looking statements, typically identified by words and phrases such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “seek,” “should,” “will,” “would,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target” or the negative of such words and other comparable terminology. However, the absence of these words does not mean that a statement is not forward-looking. Any forward-looking statements expressing an expectation or belief as to future events is expressed in good faith and believed to be reasonable at the time such forward-looking statement is made. However, these statements are not guarantees of future events and involve risks, uncertainties and other factors beyond Belpointe PREP’s control. Therefore, we caution you against relying on any of these forward-looking statements. Actual outcomes and results may differ materially from what is expressed in any forward-looking statement. Except as required by applicable law, including federal securities laws, Belpointe PREP does not intend to update any of the forward-looking statements to conform them to actual results or revised expectations.

©2022 Belpointe PREP, LLC. All rights reserved.