Capturing And Sheltering Capital Gains Into Market Strength

Is the timing good for considering harvesting stock market profits and sheltering year-end capital gains? Stocks have posted heady returns of late, and the deadline for sheltering 2023 capital gains into Qualified Opportunity Funds (“QOFs”) is fast approaching. Now is the time to consult with your tax advisors, accountants, and estate planners about potentially capturing profits and rolling those gains into a long-term, tax-advantaged government-sanctioned program—one that Congress is currently looking into expanding and enhancing.

The latest development within the world of falling interest rates is the emergence of pockets of bullish sentiment for commercial real estate heading into 2024. The cost of capital is coming down, which benefits developers bringing projects like new multi-family residential developments online.

Unlike many private QOFs, investing in Belpointe OZ is as simple as buying any other publicly traded equity. If you purchase Belpointe OZ’s Class A units in the open market, there is no subscription agreement or investor certification required; you can simply purchase Class A units through any brokerage account. Belpointe OZ offers the same Opportunity Zone tax benefits as any private structure. To properly defer your reinvested capital gains, your accountant will need to file IRS Forms 8949 and 8997 with your tax returns. You will need Belpointe OZ’s EIN, which can be found here: Belpointe OZ EIN

Further, in its effort to disrupt the U.S. real estate industry, Belpointe OZ is charging among the lowest fees in the market, including:

- No investors servicing fees;

- No disposition fees;

- 0.75% annual management fee; and

- 5% carried interest.

It seems to me that the bond market rally of the past six weeks has overwhelmed all other would-be negative stock market catalysts that were front and center headlines during the latter part of October. As I see it the cumulative effects of an Israel-Hamas war that threatened to broaden out regionally, the potential for a government shutdown, a 10-year T-Note yield hitting the 5% level, uncertainty of demand within the Treasury auctions and slowing economic data from China were no match for the power of lower bond yields set in motion by tame inflation data. The move from 5.0% to 4.13% for the 10-year Treasury has proven to be beneficial for stock market gains.

During the same past six weeks, mortgage rates have also made a similar dramatic move lower in lockstep with the decline in long-term yields. 30-year fixed rates that were as high as 7.8% on October 26th now dropped below 7.0% as of December 14, with the 15-year fixed rate falling to 6.4% in similar fashion. The radical adjustment in investor sentiment towards the Federal Reserve’s monetary policy has been swift and decisive, resulting in the stalwart move higher for equities heading into year-end.

Source: Freddie Mac, Mortgage Rates Drop Below Seven Percent (on file with author).

Belpointe OZ has projects in Sarasota and St. Petersburg, Florida. Both projects are located in the downtown districts within each city, close to the waterfront and key points of interest for work, dining, shopping, entertainment, and leisure activities.

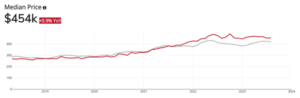

Median home prices have held steady in Sarasota even as mortgage rates more than doubled in the past two years, furthering the investment proposition for owning and operating Class-A, full-featured apartments in downtown Sarasota at a time when housing prices may continue to climb given a more favorable mortgage rate environment.

We believe Belpointe OZ’s most recent disclosure of its net asset value (“NAV”) at $103.50 per Class A unit presents a highly unique opportunity, because its Class A units are trading at $71.95 as of December 14. Such a steep discount to NAV offers investors genuine upside potential and attractive exposure to the full-featured apartment category in target markets that our research shows are experiencing growth both in terms of migration trends and employment opportunities.

We are available through this holiday season to accommodate advisors and investors that desire assistance to facilitate transactions to meet the deadline for sheltering 2023 capital gains realized in the past 180 days going back to mid- June 2023.

Happy Holidays!

Belpointe OZ

255 Glenville Road

Greenwich, CT 06831

T: (203) 883-1944

E: IR@belpointeoz.com

The information in this communication is for illustrative, educational and informational purposes only and is subject to change. Nothing in this communication is or should be construed as an offer to sell or the solicitation of an offer to buy any securities. Offers may only be made by means of a prospectus.

Belpointe PREP, LLC (“Belpointe OZ”) has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Prior to making an investment decision, you should read Belpointe OZ’s prospectus and the other documents that it has filed with the SEC in their entirety, and carefully consider its investment objectives and strategy, risk factors, fees and expenses and any tax consequences that may results from an investment in the offering. Copies of these documents can be obtained free of charge from www.sec.gov or investors.belpointeoz.com or from any broker-dealer participating in the offering.

The information in this communication should not be relied upon as investment or tax advice. You should consult with your own investment and tax advisers concerning the federal, state and local income tax consequences of purchasing, owning or disposing of securities in the offering, and of Belpointe OZ’s election to qualify as a partnership and qualified opportunity fund for federal income tax purposes. There is no guarantee that Belpointe OZ will continue to qualify as a partnership or qualified opportunity fund.

Past performance is not an indicator or a guarantee of future performance. An investment in the offering to which this communication relates involves a high degree of risk, including a complete loss of your investment, and may not be suitable for all investors. The price of Belpointe OZ’s securities will fluctuate in market value and may trade above or below net asset value. Brokerage commissions and expenses will reduce returns.

The offering to which this communication relates is being made on a best-efforts basis on behalf of Belpointe OZ through Emerson Equity, LLC, Member FINRA, SIPC, as managing broker-dealer.

©2023 Belpointe PREP, LLC. All rights reserved.